A budget gives you an overview of your finances and shows what you spend your money on, what you waste them on and, if necessary, how you can rearrange them. Whether you are on the minus at the end of each month or never spend too much money, it never hurts to have a financial overview.

It takes no more than four simple steps to make a budget that you can actually keep. We’ve created a guide for you, starting with 4 easy tips & tricks that can help you along the journey.

- Find your earnings

To find out how much you can spend, it’s a good idea to first know how much you even have available to spend. Thus, the first step in your budget plan is to find out what your monthly income is. So, what does your account say when the salary hits? Add up all your other sources of income including allowances (if you’re still lucky to get some!), earnings from your side gigs etc.

- Keep track of your expenses

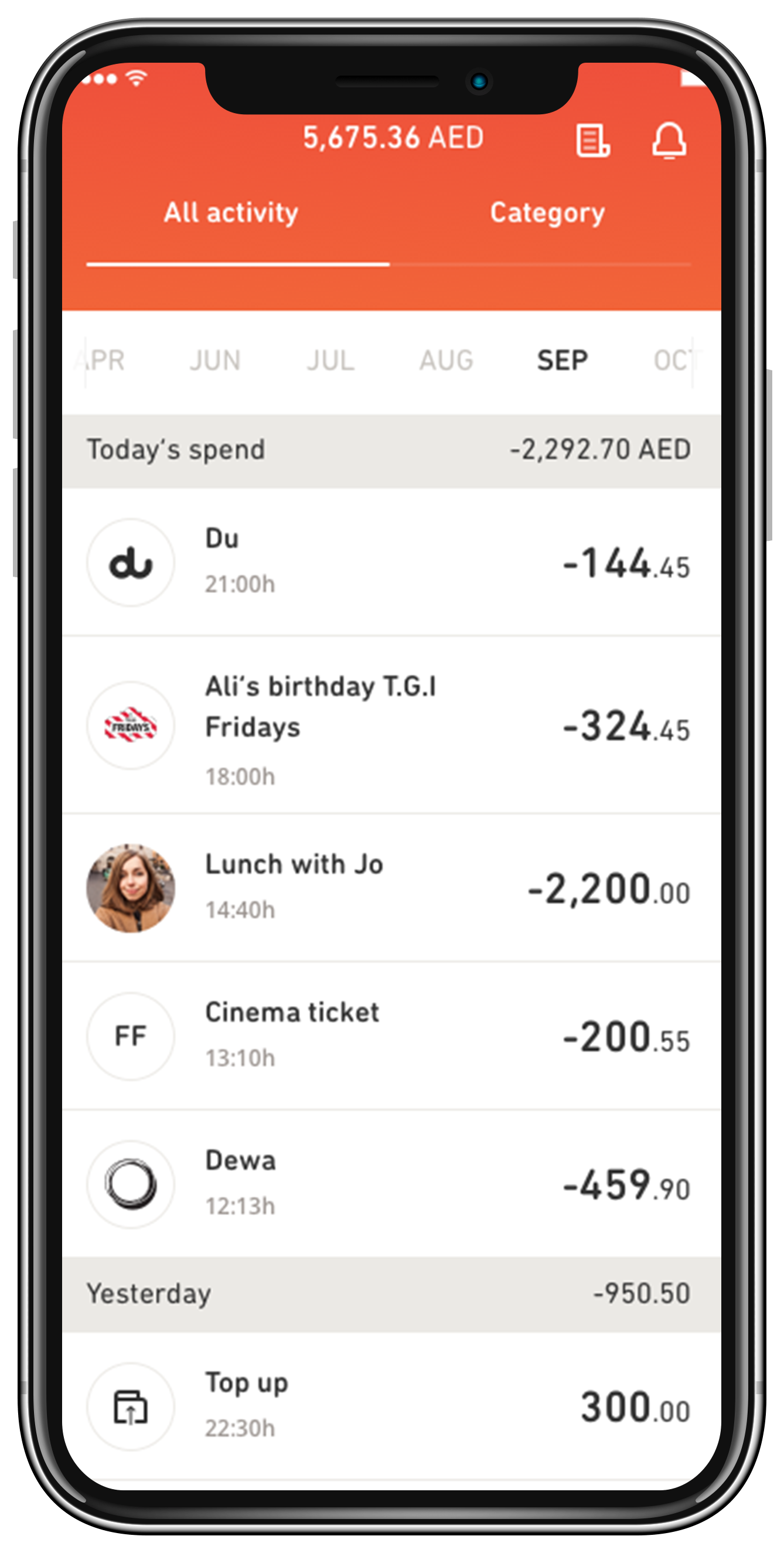

In order to get a hang of your money status, it’s important to know what you are spending it on. You get a clear overview if you go through your transactions in the last three months (Did you know that Liv makes it so much easier for you with the Categorization feature?) Write down everything you have spent your money on.

This may seem like an overwhelming part of the process, but it’s actually the most important one. This is where you gain insights into your spending habits - both the good, the bad and the ugly. Remember to be honest with yourself in this part of the process because if you do not chart your spending properly, your budget will never hold.

- Prioritize your spending

You’re halfway there! Once you get an accurate overview of what you earn and what you spend your money on, make a list of your spending based on priority. You can divide them into three groups:

- Fixed expenses

The must-set-aside money for rent, bills, food, transport, education etc.

- Fun spending

The good things in life, but not really essentials such as shopping, entertainment and subscriptions (Reality check, Netflix is not part of the fixed expenses group.)

- Delayed spending

That means save now spend later. Set money aside for a trip, a new gadget or just for a rainy day. We’d say it’s a good idea to put aside a portion of your monthly income into a goal-based saving pot.

- Fixed expenses

-

Set your budget and review it

Once you have an overview of your income, expenses and priorities, you are ready to make a budget. Woot woot! Start with the top of your priority list - when all fixed expenses are paid you can see just how much you have left for fun spending.

If your fun spending means you can't afford to put anything aside for future expenses, you could consider whether you are willing to cut down on eating out every other day or shopping for an already full wardrobe.

Here’s a good rule of thumb for y’all:

- Fixed expenses should preferably not be more than 50% of your expenses.

- Fun expenses should not be much more than 30%.

- Ideally, you should be able to put at least 20% of your income aside for future needs.

Having said that, don’t get stressed if it’s too much for you to set aside 20%. Remember, as long as you’re saving something each month and that your ‘fun expenses’ aren’t being too fun that you cannot afford to put money aside, you’ll be good.

If you’re still unsure of what to do, use your priority list. Start from the bottom and remove what you can avoid. Let yourself know that there may be expenses or habits you need to change or completely quit to get your money matters settled.

Finally, remember this is not a one-time budget for life. Do come back to do this exercise every month (or every few months) and readjust your plans to your growing needs.